ASC 606, also known as Accounting Standards Codification 606, is a comprehensive standard issued by the Financial Accounting Standards Board (FASB) that outlines the principles for recognizing revenue from contracts with customers. This standard was developed to create a consistent and comprehensive framework for revenue recognition, replacing the previous guidance that varied across industries.

Contents

Why ASC 606 Was Introduced

Before delving deep into ASC 606 revenue recognition, let’s get to know why ASC 606 was rolled out in the first place. The introduction of ASC 606 was a response to the need for greater transparency and comparability in financial reporting. Prior to its implementation, revenue recognition practices varied widely among industries, making it challenging for investors and stakeholders to assess a company’s financial performance accurately. ASC 606 aimed to address these issues by providing a unified standard applicable to all industries.

Key Principles of ASC 606

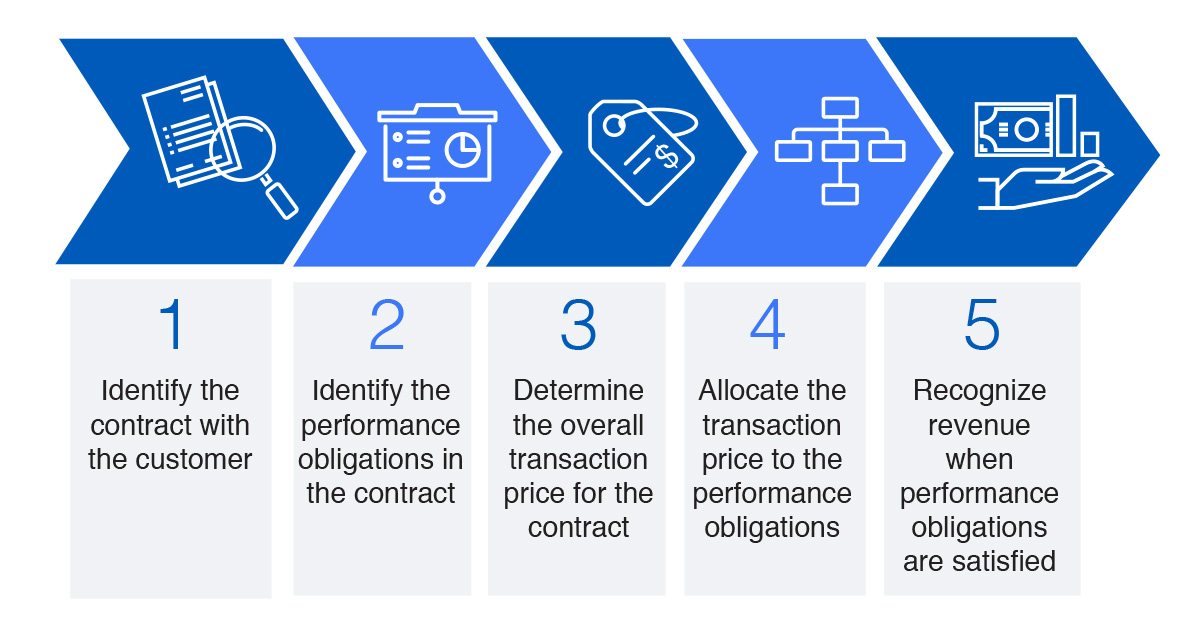

ASC 606 introduced a five-step model for recognizing revenue, which is designed to provide a structured approach for businesses to follow:

Identify the Contract: The initial step is to identify the contract with the customer. In simple terms, A contract is just an agreement between two parties that makes way for enforceable rights and obligations.

Identify Performance Obligations: Once a contract is identified, the proceeding step is to identify the performance obligations within the contract. Performance obligations are nothing but promises to transfer goods or services to the customer.

Determine the Transaction Price: Businesses need to finalize the transaction price, which is the amount of consideration they expect to receive in exchange for fulfilling the performance obligations.

Allocate the Transaction Price: If a contract contains multiple performance obligations, the transaction price needs to be allocated to each obligation based on their relative standalone selling prices.

Recognize Revenue as Obligations Are Fulfilled: Revenue is recognized as the business fulfills its performance obligations, either over time or at a point in time, depending on the nature of the goods or services being provided.

Steps to Achieve ASC 606 Compliance

Achieving compliance with ASC 606 can be a complex process, but it’s essential for businesses looking to accurately report their financial performance. Here’s a step-by-step guide to help you navigate the road to ASC 606 compliance:

Step 1: Assess the Impact

Begin by assessing the impact of ASC 606 on your financial statements. Identify contracts with customers and evaluate how the new standard will affect revenue recognition for each contract. This initial assessment will provide insights into the extent of changes required.

Step 2: Gather Data

Data collection is a crucial aspect of ASC 606 compliance. Gather all necessary data related to contracts, performance obligations, transaction prices, and standalone selling prices. Ensure that your data is accurate, complete, and well-organized.

Step 3: Evaluate Contracts

Review and evaluate your existing contracts with customers to determine whether they meet the criteria for recognition under ASC 606. Identify the performance obligations within each contract and assess how transaction prices should be allocated.

Step 4: Adjust Accounting Policies

ASC 606 may require adjustments to your accounting policies. Ensure that your policies align with the standard’s requirements, especially in terms of recognizing revenue over time or at a point in time.

Step 5: Implement Changes

Implement changes to your accounting systems and processes to accommodate ASC 606 requirements. This may involve updating software, training staff, and establishing procedures for ongoing compliance.

Step 6: Test and Review

Perform testing and review procedures to ensure that your revenue recognition practices are in accordance with ASC 606. Identify potential discrepancies or issues that need to be addressed.

Step 7: Document Compliance

Document your compliance efforts thoroughly. Maintain records of contracts, data, policies, and procedures related to revenue recognition. This documentation will be essential for audits and financial reporting.

Step 8: Monitor and Adapt

Once you achieve compliance, continue to monitor your revenue recognition practices. As your business evolves and enters into new contracts, assess whether any changes are needed to maintain compliance with ASC 606.

Additional Resources

For businesses seeking further guidance on ASC 606 compliance, there are resources available, including accounting firms and industry associations. Consider consulting experts in revenue recognition or accessing industry-specific guidance to ensure a smooth transition to ASC 606 compliance.

ASC 606 represents a significant shift in revenue recognition standards aimed at improving transparency and consistency in financial reporting. Navigating the road to ASC 606 compliance requires a structured approach, careful assessment of contracts, and ongoing monitoring to ensure accurate revenue recognition. By following these steps, businesses can align their practices with the standard and provide stakeholders with a clearer understanding of their financial performance.